09 Oct Risk and Responsibility for Truck Brokers

Freight brokers face increasing legal, financial, and operational risks: not just from their own mistakes, but also from the negligence of the motor carriers they hire. In some cases, brokers are held responsible for negligent hiring if a carrier’s actions cause damage, even though the broker never physically handled the freight.

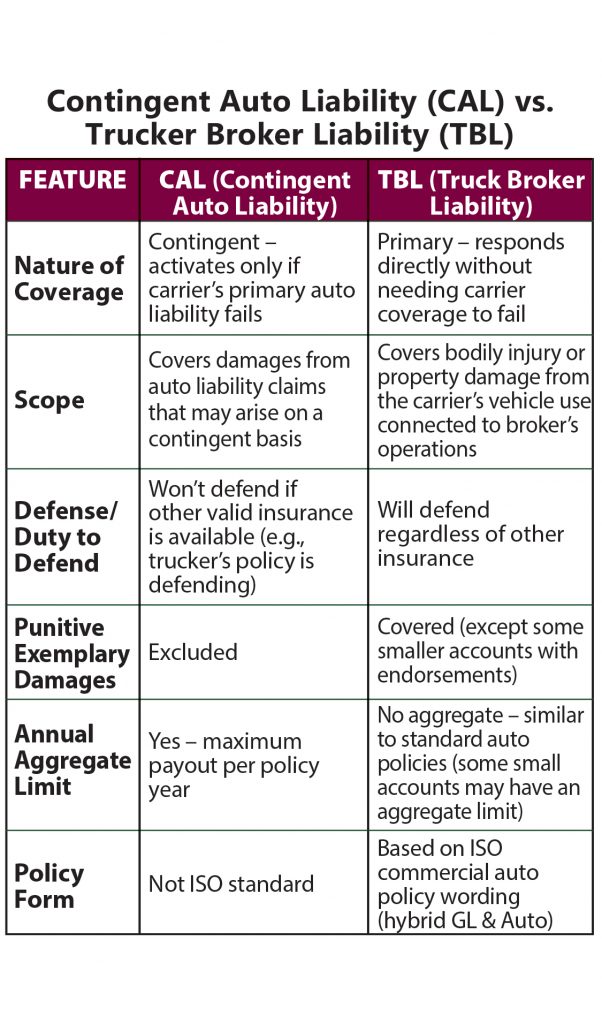

With shipper demands increasing, brokers are being pushed toward more primary coverage options that protect both themselves and their clients. Below are some tools that will help try to limit broker risk and reduce fraud in the day-to-day operations.

Contingent Cargo vs. Broad Form Primary Cargo

Freight/Truck brokers are not legally liable for cargo loss or damage by their authority alone, but shippers still hold brokers accountable by contractual requirements (broker–shipper agreements) requiring full indemnification for any freight loss involving the broker and cargo insurance, regardless of whether the carrier’s policy pays. In cargo claims, brokers often help shippers/consignees recover damages from the carrier or their insurer. Poor carrier insurance or refusal to pay can leave the broker covering the loss to maintain good business relationships.

- Contingent Cargo:

- Limitation: Coverage only responds if the carrier’s policy doesn’t.

- Covers the broker if a carrier’s cargo insurance fails to pay for a covered cargo loss.

- Broad Form Primary Cargo

- Preferred when shippers demand certainty and quick claim processing. This coverage is available for FTL (Full Truck Load) shipments for most commodities shipped.

- Covers cargo loss/damage as primary coverage, coverage when a freight broker agrees to assume responsibility for cargo loss or damage that a motor carrier fails to pay.

Cyber Liability

With trucking systems increasingly reliant on ELDs, GPS tracking, automated freight platforms, and cloud-based operations, cyber risk is growing rapidly. Threats include:

- Funds Transfer Fraud – Hackers redirect payments.

- Extortion/Ransomware – Locking systems until ransom is paid.

- Corporate Identity Theft – Using broker credentials to commit fraud.

- Telephone Hacking – Exploiting VoIP or PBX systems.

- Privacy Breaches – Leaking sensitive shipper, carrier, or employee data.

Why it matters for brokers:

A Cyber breach can cause direct financial loss, operational shutdowns, and liability to clients if confidential data is exposed.

Professional Liability (Errors & Omissions)

Covers financial losses from broker mistakes not involving bodily injury, property damage, or cargo damage.

Examples:

- Misdelivery – Goods sent to wrong address due to broker’s instructions.

- Miscommunication – Wrong delivery date promised to consignee.

- Regulatory Errors – Load seized because broker misunderstood legal requirements.

- Discrimination – Favoring one carrier over another in a way that causes loss.

- Negligent Hiring – Selecting an unfit carrier who causes a non-injury, non-cargo loss.

- Negligent Acts & Omissions – Any operational oversight causing financial harm.

Not covered under E&O:

- Cargo loss/damage (Contingent Cargo or Primary Cargo covers this).

- Bodily injury/property damage (TBL or GL covers this).

Whether you have a Motor Carrier Authority with Brokerage Authority or have a separate Brokerage operation, please give us a call to discuss the proper insurance for your business.

Thank you.

NASTC Insurance Services, LLC – 844.264.8500 / nastc.insurance@nastc.com